How it all started:

- 📞 Initial Contact: Mohammed reached out 16 years ago after finding my website ranked #1 for managed forex accounts.

- 🤝 Trust Established: Our long conversation led him to trust me as a German economist and lawyer.

- 🇨🇭 First Meeting: A year later, we met in Gstaad, Switzerland, and began working together in forex.

- 🌍 Continued Collaboration: We stayed in touch, and this year, Mohammed introduced me to his successful gold trading and hedge strategies.

- 💼 Investment Opportunity: Mohammed presented an impressive fund that focuses on promising start-ups, mostly using AI.

- 🇺🇸 US Connection: The fund is co-managed from the US, with investments in Silicon Valley startups.

- 🎓 Full Circle Moment: Visiting my son at Stanford in 2010, we saw Facebook at 500M users—now, I’m involved in investing in start-ups from the same region.

Mohammed is one partner besides the fund manager in their US-office. I feel honored to be allowed to promote such an outstanding offer worldwide to my audience, which is only possible due to my long-year relation with Mohammed. Of course the fund also invests in Silicon-Valley start-ups.

Back in 2010 I visited my son in PaloAlto after he had finished summer school in Stanford. So in a way a circle is closing for me. Facebook, which was still around the corner of the campus at that time, was introducing a new feature and celebrating 500M active users. We got in and could talk to the crew and lots of press people. My son could even talk to Mark Z. for a while. Would be impossible today – now they have over 3 Billion users.

Together with my partner Peter, a German Math-Professor, we kind of committed to raise at least $10 M till end of this year when the fund will be closed. Not much money as the head-fund manager, a graduate of the Harvard Business School, says, but still enough to move the needle and worth his time.

You may have the impression that investing in start-ups seems like gambling with only maybe 1 out of 10 tunrning out to be profitable in the end for you, then you’ve come to the right place. To the VERY FIRST and ONLY “early stage AI seed focused Venture Captial Fund” that developed a unique algorithm and interview process that filters down from 50-75k applicants to only the really very best 25-40 investments of already filtered best startups.

Means you no longer have to rely on your own limited potential of doing your due-diligence and believing in good startup pitches, no now you can rely on this no-brainer system that does it all for you finding the future unicorns while you can sit back.

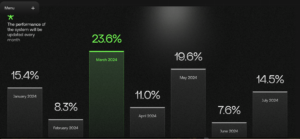

Imagine how this will change the odds in your favor! Proven by the top performance of the previous two similar funds of this fund manager and his team.

Due to my relation with Mohammed I could arrange the minimum to be only 250k USD instead of 1 M USD (which can even go low as 50k- see further down). It is a US-Registered Fund, so they can take US-investors including all from the rest of the world except from the normal suspects we all know like North-Korea or Irak, Iran, Yemen etc. Now I can offer three slots with a min. investment of only $100k!

To me their proprietary “secret sauce” is that with this fund they managed to install a second level of filtering which means: while the top 5 accelerators do 2.500-10.000 interviews from 50-75k applications from worldwide they use these data and filter once again down to 100-150 interviews leading to only 25-40 seed investments. Imagine: you now have access to the very best of the best and this with a fairly low min. investment.

- In case you can only invest $250k together in a group the fund manager says: So, if a group wishes to pool together in their own entity… as long as it’s at least $250k coming in with one entity name, this can work. So the group may consist of 2-5 members in order to meet the minimum but could be as well 10 or more members – always with a min. of $50k for each.

- See this picture below just to illustrate the data they work with and use to filter down even much further to their own level.

- Given you can invest alone or within a group as outlined above please reply to my email that you find below and you will get a 25-page detailed presentation with many examples of selected startups and all details that the fund manager is also prepared to explain to you all in a short Zoom call! There is even an option to stretch your investment in rates over a certain time. Just talk to the fund manager. My email: info@forex-investors.de

You can check the main features of the offer here!