Back to the roots – back to managed forex!

NOW READY: Hawaii-Trading – Min. Investment now only $1000

After over 15 years in managed forex, I changed to crypto in early 2020, when COVID-19 started. At that time, my leading forex trader kept trading in the wrong direction, hoping for a reversal, which never came. However, the pandemic then affected all markets, with Bitcoin going down to around $4k.

If you like, you can read my story here

Well, I changed to crypto in early 2020. While my investors and I were very successful until the fall of 2022, we didn’t want to recognize the very high risk of masternoding, which was our crypto deal in Malta.

Although I said to myself for quite a while: no more trading, fortunately in the meantime, I checked several offers in more detail, and I was blown away.

It made me think: why not offer some very promising offers!?

Out of curiosity, I asked around last summer whether anybody would like managed forex offers, and the replies were very positive. I should have listened earlier.

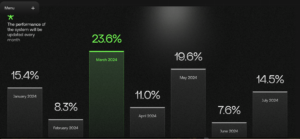

Please check our Portfolio on the right-hand side.